Financial institutions face a persistent challenge in today’s competitive deposit market: how to attract and retain customers with substantial cash balances when FDIC insurance covers only $250,000 per depositor, per bank, per ownership category.

Smart depositors understand this limitation and actively seek protection for their large balances. They know they can either disperse their funds across multiple institutions or turn to larger banks that offer expanded coverage solutions. This insurance limitation creates a competitive disadvantage for community banks and trust companies, as many of their valuable customer relationships migrate to perceived “safer” alternatives.

However, expanded FDIC coverage solutions level the playing field. Enabling institutions to offer expanded coverage on large deposits, regardless of the institution’s size, allows community banks and trust companies to compete effectively for high-net-worth depositors.

The Competitive Challenge: Deposit Retention

Large depositors are exceptionally valuable customers for financial institutions. They often use multiple services—including lending, treasury management, and trust services—which helps keep them profitable across the entire relationship lifecycle. Their substantial balances also provide stable, low-cost funding that institutions use for lending operations.

Smaller banks and trust organizations that don’t offer deposit protection to their customers may find themselves at a competitive disadvantage. Customers perceive large institutions as inherently safer, which leads to deposit flight. This competitive pressure results in missed deposit opportunities and constraints on balance sheet growth through lost stable funding sources.

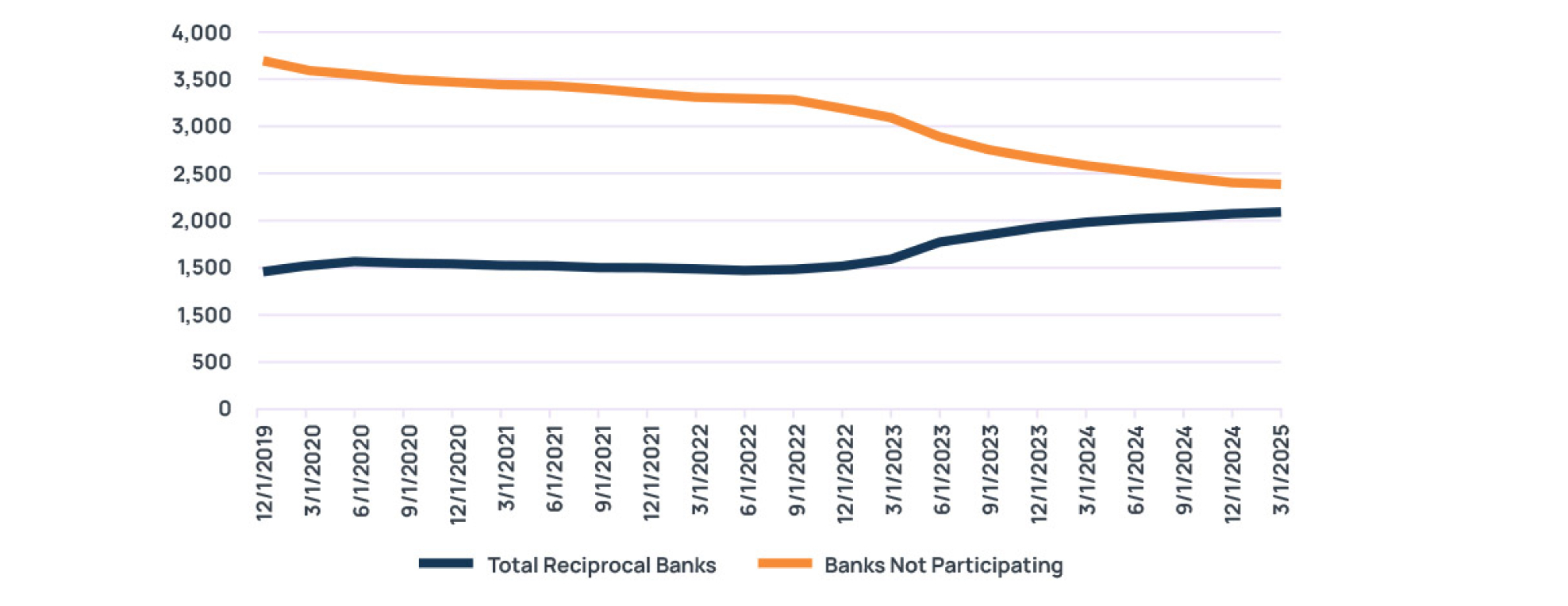

The rise in reciprocal deposits, from $156 billion in December 2022 to $422 billion by March 2025 (based on FFIEC call reports), reflects the institutions’ response to these competitive pressures.

Understanding Reciprocal Deposits

Expanded deposit protection starts with understanding reciprocal deposits. The 2018 Economic Growth, Regulatory Relief, and Consumer Protection Act gave community banks and trust companies powerful new tools to compete for large deposits by creating favorable regulatory treatment for these arrangements.

The key benefit is that well-capitalized and well-rated institutions can treat reciprocal deposits as non-brokered, up to the lesser of $5 billion or 20% of their total liabilities. The ability to treat reciprocal deposits as non-brokered offers a significant regulatory advantage over traditional brokered deposit funding.

Here’s how it works:

-

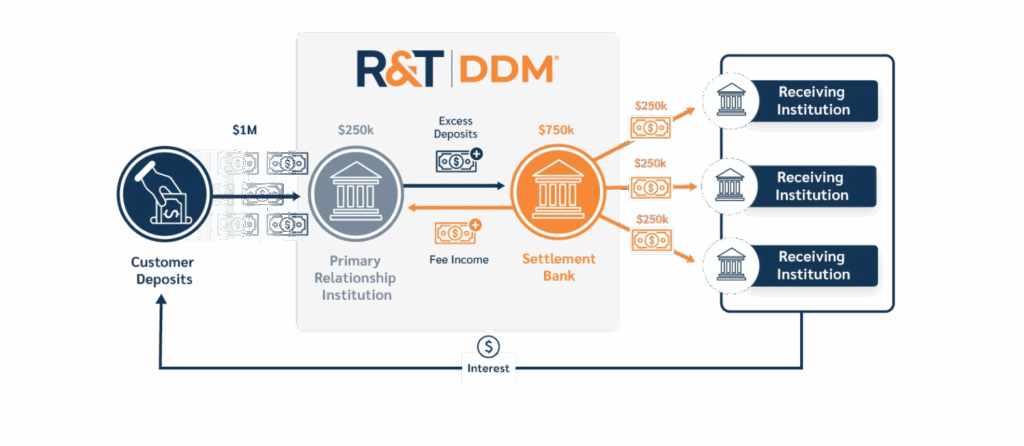

When you participate in a reciprocal deposit network, customers deposit large amounts with your institution. You then distribute those funds across network partners in increments of less than $250,000.

-

Network partners send equivalent deposits back to you, so you maintain the whole relationship while providing expanded FDIC coverage.

-

Customer funds stay local for your lending and investment activities, but you’ve solved the deposit protection challenge that might otherwise drive customers to larger competitors.

Beyond customer retention, reciprocal deposits offer your institution several strategic advantages. The favorable regulatory treatment allows you to classify these as non-brokered deposits, which helps with compliance and reduces regulatory restrictions. You also gain operational flexibility—when you need deposits for lending, you keep the customer funds locally. When you have excess liquidity, you generate fee income through the network while maintaining the customer relationship. This flexibility creates a sustainable revenue model that adapts to your institution’s changing needs.

Let’s examine the two primary approaches to implementing a reciprocal deposit framework and their benefits to financial institutions: cash sweep programs for responsive deposit management and certificate of deposit programs for stable growth.

Cash Sweep Solutions: Responsive Deposit Management

Cash sweep programs provide the most responsive approach to serving large depositors with fluctuating balance needs. They’re particularly valuable for attracting business accounts, municipal deposits, and trust relationships that require both protection and liquidity management.

What Is a Cash Sweep Program?

At the close of each business day, your institution’s core banking system automatically assesses customer account balances and determines excess funds above predetermined thresholds that need to be swept into interest-bearing accounts across multiple FDIC-insured network institutions. Programs like the Demand Deposit Marketplace® (DDM®) provide the technology platform that facilitates the placement of these determined amounts across network institutions. This automated process provides customers with access to expanded FDIC coverage on large balances, interest earnings on previously idle funds, single relationship simplicity, immediate liquidity access when needed, and professional cash management without administrative burden.

Cash sweep programs can offer compelling competitive advantages for your financial institution. Businesses with substantial cash flows and expanding deposit levels – whether they’re seasonal operations experiencing cyclical variations or rapid growth companies – maintain their whole banking relationship with you rather than splitting funds across multiple banks.

Cash sweep programs also create flexible revenue opportunities that adapt to your institution’s needs. When lending demand is strong, you retain customer deposits for local lending. When you have excess liquidity, you generate fee income through network exchanges while maintaining the customer relationship. This dual capability lets you monetize deposit relationships regardless of your balance sheet position.

-

Cash Sweep Programs in Action

Consider a regional manufacturing company with seasonal cash flow patterns. During peak production months, they maintain $3-4 million in operating accounts, but during slower periods, balances reach $8 million as they build cash reserves.

-

Traditional Approach:

The company would need to manually manage multiple bank relationships to achieve full FDIC coverage on their peak balances, creating administrative complexity and relationship management challenges.

-

Cash Sweep Solution:

The company maintains their primary relationship with your institution. Each night, your core banking system automatically analyzes their balance and determines the appropriate sweep amount. When they have $8 million from strong sales periods, the core system identifies $7.5 million as excess funds to be swept, and DDM technology places these funds across network banks in $250,000 increments, leaving operating funds available.

Throughout this process, the company benefits from expanded FDIC coverage without managing multiple banking relationships. At the same time, your institution generates fee income during periods of high balance and retains the complete customer relationship for lending and other services.

Cash sweep programs also bring operational efficiency to the table, allowing staff to focus on relationship development rather than daily cash placement. This capability proves particularly valuable for several key customer segments:

-

Commercial businesses with daily cash flow fluctuations

-

Seasonal enterprises requiring flexible balance sheet management

-

Growth companies with rapidly expanding deposit levels

-

Professional service firms with project-based cash cycles

-

Trust accounts with varying liquidity needs

Certificates of Deposit: Guaranteed Returns

While cash sweep programs excel at managing daily liquidity, many customers have a different priority: guaranteed returns on funds they won’t need for specific periods. Municipalities planning for capital projects, nonprofits managing endowments, and businesses building reserves for equipment purchases all share a common need for predictable income with principal protection.

What Is a Certificate of Deposit Program?

Through reciprocal deposit networks, your institution offers customers access to certificates of deposit across multiple FDIC-insured banks, providing both expanded insurance coverage and competitive rates. Programs like the Certificate of Deposit Marketplace ExchangeSM (CDMXSM) allow you to place customer funds into CDs at participating network institutions while retaining the primary banking relationship with your customer.

-

Certificate of Deposit Programs in Action

Consider a regional hospital system that has accumulated $10 million in capital reserves for a planned facility expansion in 18 months. The CFO has two requirements: preserve principal and generate predictable income during the waiting period.

-

Traditional Approach:

The hospital would need to open CD accounts at multiple banks to achieve full FDIC coverage, which would create administrative complexity and rate shopping challenges.

-

CD Program Solution

The hospital deposits $10 million with your institution and selects 18-month CDs. Through the reciprocal network:

● Funds are allocated across 40 participating banks ($250,000 each)

● All CDs mature simultaneously in 18 months

● The hospital earns a competitive rate with access to expanded FDIC protection

● Your institution manages all aspects of the relationshipAt maturity, the hospital has predictable funds available for the expansion project, having earned competitive returns with zero principal risk.

Competitive Intelligence: Market Positioning

Large institutions often promote their size as inherently safer, but deposit protection programs neutralize this perceived advantage while maintaining local relationship benefits. Unlike large institutions where customers feel anonymous, community banks and trust companies provide expanded coverage within genuine partnership relationships. Emphasizing how keeping deposits local supports community lending and economic development, while delivering institutional quality protection, creates compelling value propositions. Positioning expanded coverage as part of comprehensive financial solutions rather than standalone products integrates these capabilities into broader relationship strategies.

Future Market Trends and Strategic Planning

The FDIC continues to evaluate deposit insurance reform options, including targeted coverage that would provide higher limits for business payment accounts. These conversations highlight the ongoing evolution of deposit protection frameworks and the importance of staying informed about regulatory developments for long-term competitive planning.

The dramatic growth in reciprocal deposits, which tripled in just over two years, indicates a significant market opportunity for institutions that develop expanded coverage capabilities.

Your Next Steps in Deposit Protection

Expanded FDIC coverage options are becoming a competitive necessity for community banks and trust companies that want to attract and retain large depositors. These solutions transform the deposit protection challenge from a competitive disadvantage into a relationship-building opportunity.

The strategic benefits are clear: you’ll retain valuable large depositors who might otherwise migrate to larger institutions, position yourself as offering institutional-quality solutions with community banking advantages, build your balance sheet by maintaining stable funding sources while providing customer value, and integrate services that foster comprehensive relationships beyond basic deposit services.

The institutions that move quickly on comprehensive expanded coverage solutions will be best positioned to compete for valuable large depositor relationships while supporting their communities’ financial needs.

About R&T Deposit Solutions

R&T Deposit Solutions specializes in helping financial institutions implement deposit protection strategies. Contact us at 866-237-752 or visit rnt.com to learn how expanded FDIC coverage solutions strengthen your competitive position and customer relationships.