Why R&T

Pioneering Service Excellence in Deposit Solutions

We help financial institutions attract, retain and protect deposits, and optimize balance sheet and capital management. We understand and anticipate your needs, delivering tech-forward and operationally resilient solutions that help optimize funding and liquidity.

The R&T Difference

Established Network

We leverage our established and diverse network of financial institutions to connect clients with trusted partners and opportunities. Our extensive client network includes hundreds of banks, depository institutions, trust and wealth managers, and broker-dealers. When combined, the power of this interdependent network enables us to maximize the value we can offer our clients.

Collaborative Approach

We partner with our clients to understand their needs and deliver tech-forward solutions that are configured to meet their unique deposit and funding needs. We prioritize service excellence and strive to help our clients grow and succeed.

Expert Team

Our team of seasoned professionals draws from their deep industry knowledge to deliver insightful solutions and guidance to our wide-ranging and sophisticated client base. By harnessing our collective knowledge, we are better positioned to offer creative solutions to our clients and continue to build a culture that understands the importance of risk management and compliance.

-

Trusted by financial institutions since 1974

-

Bankers Helping Bankers Premier Member

-

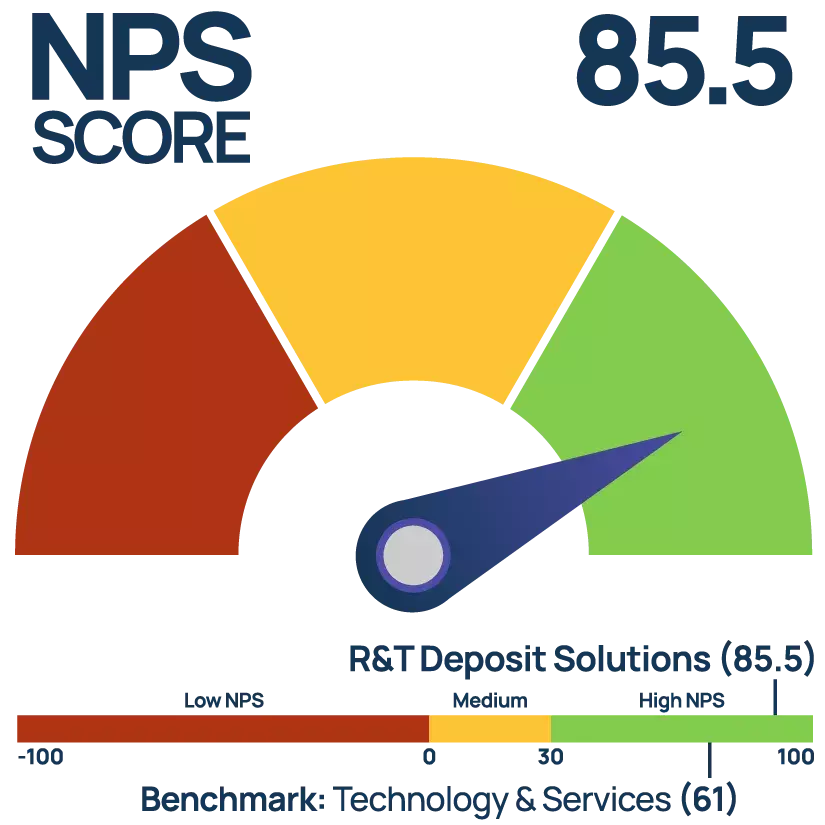

Net Promoter Scores of 85.5 in 2024 (Technology and Service Industry Benchmark is 61)1

1 Retently 2024 NPS Benchmark for B2B Retently Blog

From Our Clients