By: Jeff Zuendt, Chief Deposit Officer, R&T Deposit Solutions

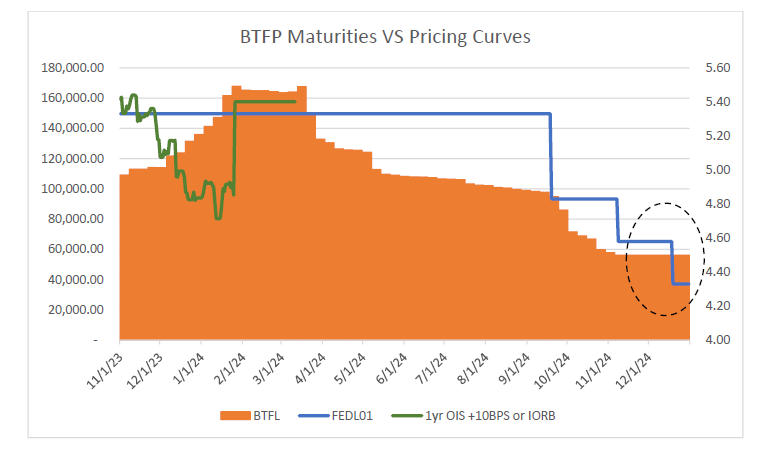

As the Bank Term Funding Program (BTFP) winds down, the financial sector faces pivotal changes in funding strategies. With the Federal Reserve likely to implement further rate cuts, the appeal of BTFP has diminished as the differential between BTFP and the Interest on Reserve Balances (IORB) narrows. Following a series of 75 basis points cuts, the IORB now sits at 4.65%, creating negative carry against most existing BTFP funding. For instance, an institution with BTFP borrowings at an average rate of 4.86%1 will experience a carry of 16 basis points if holding this funding in cash. As illustrated in the accompanying graph, this could be an opportune moment for banks to consider securing lower-cost funding options, particularly with a potential rate cut in December on the horizon.

Forward-thinking banks are actively prepaying BTFP obligations to transition to more sustainable, cost-effective funding solutions. R&T Deposit Solutions has innovative programs that can help to bolster financial resilience and reduce dependency on federal funding sources. These solutions not only align with current economic conditions but also can help banks enhance their competitive positioning and stability in anticipation of future market fluctuations.

As the industry adapts to this evolving landscape, R&T Deposit Solutions is committed to supporting banks with data-driven insights and reliable funding solutions. If your organization is looking to stay ahead of these changes, we’re here to help you navigate the road ahead.

Get more information about R&T’s Funding Solutions for Depository Institutions today.

[1] Based on the January average of the 1 Year OIS + 10BPS before the fed adjusted to IORB as a floor.

Terms & conditions apply. Click here for R&T’s list of insured receiving institutions in the DDM®and RTID® programs. R&T is not an FDIC or NCUA-insured institution. FDIC and NCUA insurance only covers the failure of an FDIC or NCUA-insured institution, respectively. Certain conditions must be satisfied for FDIC and NCUA pass-through deposit insurance coverage to apply. The DDM®and RTID® programs, themselves, as well as R&T’s other services are not insured by the FDIC or NCUA, are not deposits and may lose value in certain circumstances as described in the program terms. Click here for additional legal disclosures.