Managing balance sheet efficiency while delivering exceptional value to customers is a constant challenge for financial institutions. The Demand Deposit Marketplace® (DDM®) program offers a strategic and scalable approach to managing institutional liquidity, providing a solution for deposit protection that enables financial institutions to manage their deposits more dynamically while extending superior benefits to their customers.

Monetizing Excess Deposits with Our Send-Only Option

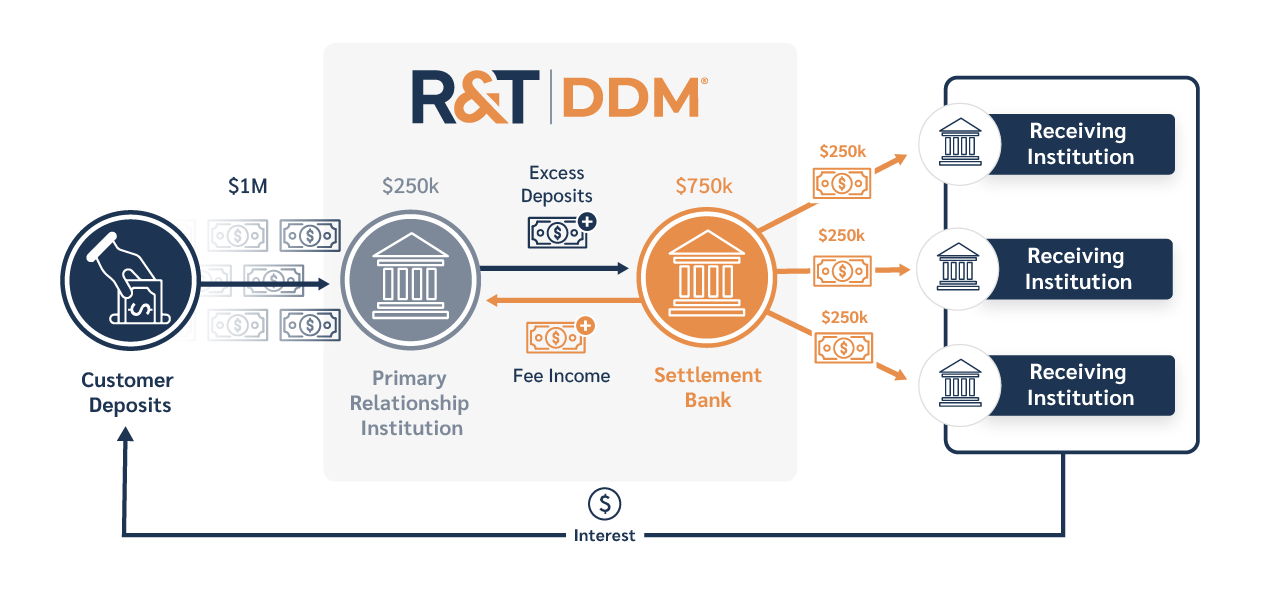

For institutions managing surplus deposits or seeking to reduce non-earning assets, DDM’s Send-Only option offers a powerful solution for enhancing liquidity and generating fee income. This one-way transaction enables a bank to move excess balances off its balance sheet to participating banks in the R&T network.

This tool goes beyond managing liquidity; it also helps generate fee income, provides customers with access to expanded deposit insurance coverage, and serves as a warehouse for deposits. This feature is particularly beneficial in scenarios where maintaining liquidity ratios is as crucial as income generation.

Key Benefits of Our Send-Only Option:

-

Balance Sheet Relief: Offload excess deposits while maintaining customer relationships.

-

Fee Income Generation: Earn revenue on balances that would otherwise sit idle.

-

Enhanced FDIC Insurance: Customers benefit from access to expanded insurance coverage, reducing their exposure to uninsured deposits

-

Liquidity Optimization: Use the DDM program as a deposit warehouse during high-liquidity cycles without compromising safety or accessibility.

How Send-Only Works:

Strengthening Your Balance Sheet with Our Receive-Only Option

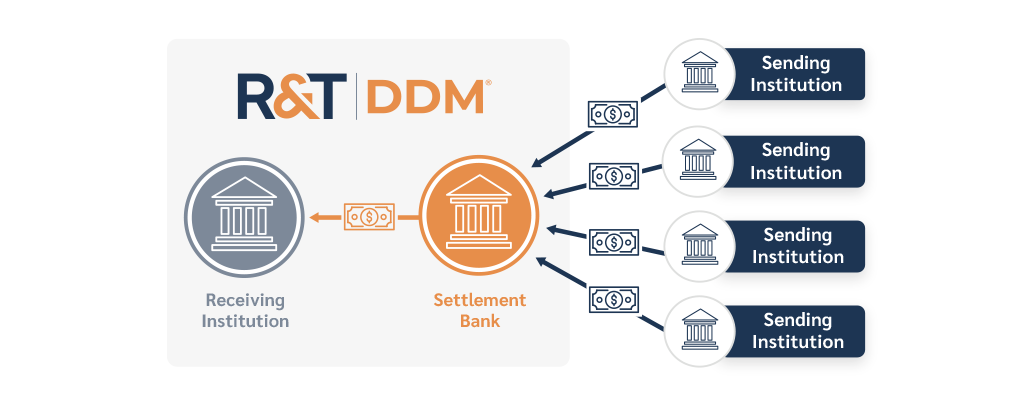

For institutions with local loan demand or long-term funding needs, the Receive-Only option offers a cost-effective alternative to wholesale funding markets. Banks can accept deposits from the DDM network to support loan growth or reinforce liquidity buffers.

Key Benefits of Our Receive-Only Option:

-

Cost-effective funding

-

Diversified wholesale funding deposit source

-

Liquidity planning

-

Increased insured deposit ratio

How Receive-Only Works:

Flexibility and Growth with Reciprocal Options

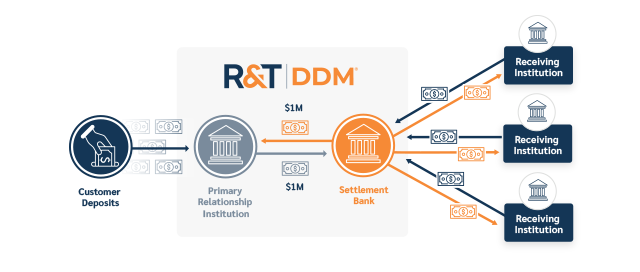

The DDM program also offers “Reciprocal” options, where institutions can exchange deposits on a dollar-for-dollar basis. This feature not only retains valuable deposits and relationships but also reduces uninsured balances, thus maintaining the stability and trust of your customers.

How the Reciprocal Option Works:

- Send and receive equal amounts

- Maintain a balance sheet while offering access to an FDIC-insured product to your customer

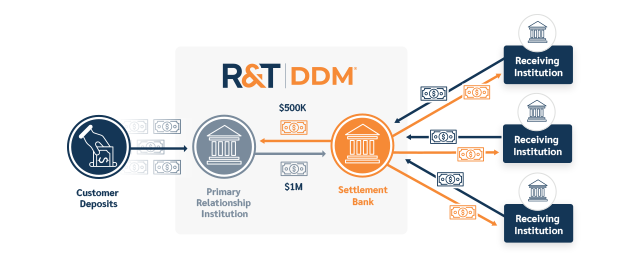

For institutions seeking more tailored solutions, the “Reciprocal Plus/Minus” option enables adjusting the deposit ratios according to current needs and market conditions, providing unmatched flexibility in deposit management.

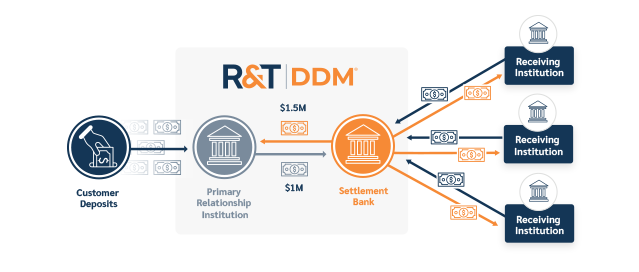

How the Reciprocal Plus/Minus Works:

- Send $1M, receive $500K back

- Reduce balance sheet size while offering access to an FDIC-insured product to your customer

- Send $1M, receive $1.5M back

- Increase balance sheet funding with higher insured inflow

Meeting Complex Needs with Simple Solutions

Consider a traditional banking scenario where a high ratio of uninsured to insured deposits poses risks to stability. The DDM program can transform this challenge into an opportunity by retaining deposits through reciprocal transactions while sending excess balances securely through the R&T network.

The program not only preserves the principal amount but also offers competitive returns1 compared to traditional investments such as U.S. Treasuries or Money Market Funds (MMFs).

How the DDM Program Simplifies Complex Deposit Challenge:

-

Use Reciprocal to retain deposits and offer access to expanded FDIC insurance coverage.

-

Use Send-Only to offload excess without losing the client relationship and offer your clients the protection they need.

-

Position the bank as an attractive option for high-net-worth or business clients concerned about deposit safety.

Optimize Balance Sheet Management

The DDM program is more than a sweep platform—it’s a strategic partner in managing deposits and balance sheet needs with intelligence and agility. Whether you are managing liquidity surpluses, funding loan growth, or addressing customer concerns about deposit safety, the DDM program offers a suite of options to meet your institution’s goals.

By participating in the DDM program, institutions can not only help meet regulatory requirements more effectively but also offer their clients the security of access to expanded FDIC insurance coverage, all while managing their liquidity needs flexibly. This approach to balance sheet management empowers banks to navigate the complexities of modern financial environments with confidence and strategic advantage.

Elevate your institution’s balance sheet management strategy with the DDM® program.

USE CASE: Bank Increases Relationship Balances and Improves Customer Rate with R&T

1While interest rates obtained on funds placed at receiving institutions under the DDM program may, under certain circumstances, outperform cash alternatives, such as money market funds, the primary objective of the DDM program is to provide customers with convenient access to expanded deposit insurance coverage on their funds (and not for investment enhancements or higher rates of returns or profits).