Loan Management System (LMS)

Streamline Loans. Offer Profitable SBLOCs. Attract More Customers.

Automate your securities-based lending process with an end-to-end origination, underwriting and collateral evaluation and monitoring platform.

Our Loan Management System (LMS) is a cost-effective platform that allows your firm’s customers’ to access liquidity using their securities as collateral. It enables you to streamline the origination, underwriting, collateral evaluation, and monitoring of securities-based lines of credit (SBLOCs).

SBLOCs provide a tax-efficient way to help your customers finance a range of short-term liabilities, including payments to beneficiaries, annual gifts, large purchases, annual donations or business financing. With LMS, SBLOCs can be initiated quickly with our fully automated, end-to-end solution.

Benefits to Your Customers

- Cost-effective and tax efficient

- Streamlined application process

- Higher borrowing power

- Approval and funding in 24-48 hours

Benefits to Trust & Wealth Managers & Broker-Dealers

-

Automated: Initiate SBLOCs in minutes with our turnkey, end-to-end solution that automates the entire origination, underwriting, and collateral monitoring process.

-

Flexibility: The modular design supports your unique business needs and integrates seamlessly with internal and external systems.

-

Competitive Edge: A comprehensive offering to help attract and retain experienced advisors.

-

Support: In-field sales professionals, wholesale product training, and a network of third-party lenders to support your business.

-

Security: Designed to help you meet your customers' privacy and data security needs.

-

Scalable Advisor Recruiting: Automated transition of existing pledged accounts to simplify the recruiting process and seamlessly onboard advisors and their customers.

Benefits to Banks & Depository Institutions

-

Automation: Initiate SBLOCs in minutes with our turnkey, end-to-end solution that automates the origination, underwriting, and monitoring of SBLOCs at scale.

-

Diversification: Diversify loan portfolios by asset class, geography, and business line.

-

Flexibility: Fixed or floating rate categorized as commercial or consumer.

-

Security: Designed to help you meet your customers' privacy and data security needs.

-

Support: Industry experience, financial intermediary relationships, wholesale product training, and in-field sales support.

How it Works

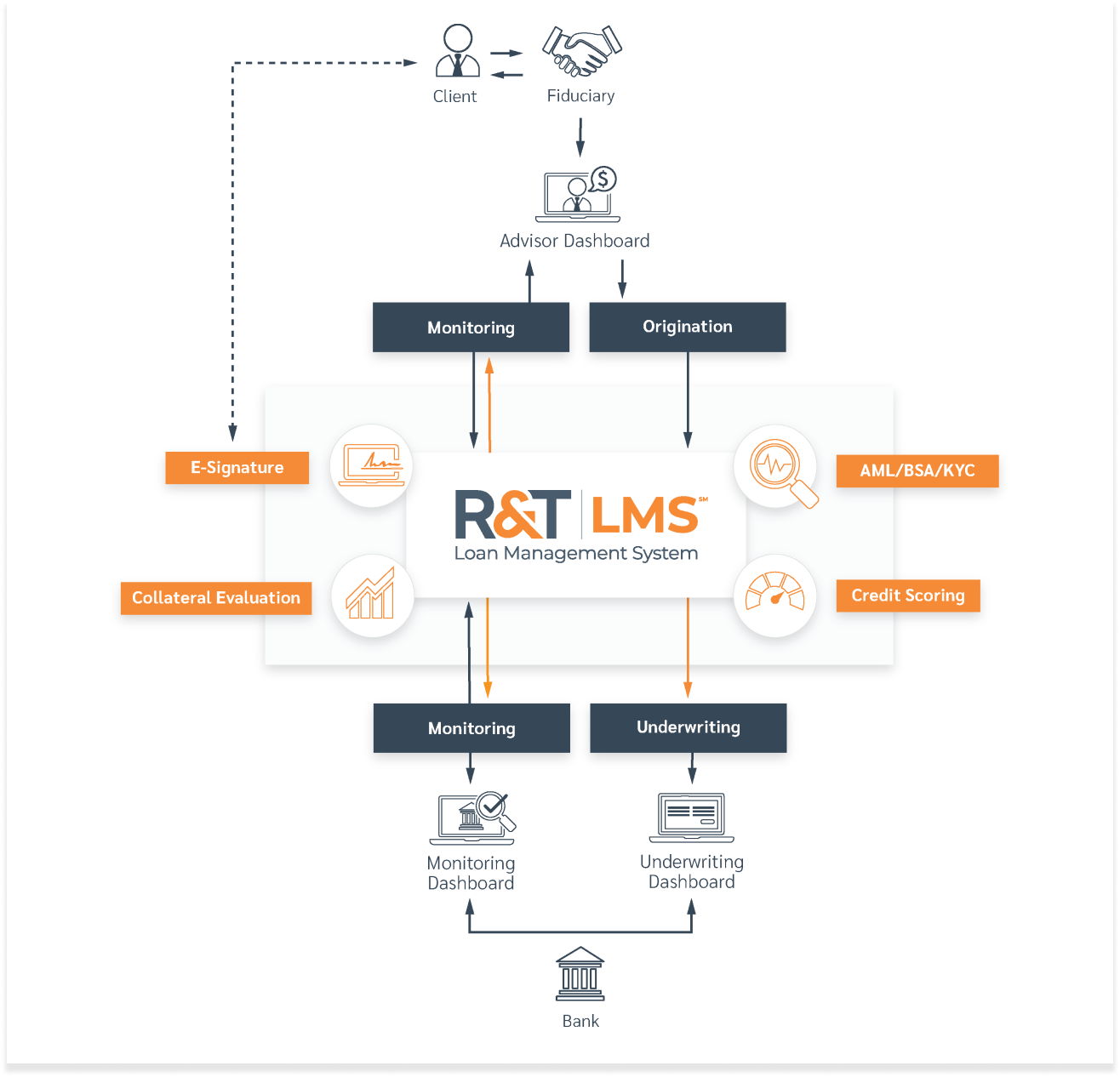

Our turnkey Loan Management System (LMS) is simple to use and intuitive. Modular by design, it provides the flexibility to operate as a complete stand-alone system or integrate with external providers.

Using the configurable and branded interface, you can quickly identify accounts, evaluate portfolio collateral, price loans and generate pre-populated loan applications for clients in minutes. Once the application is complete, LMS streamlines the underwriting process, including AML/BSA/KYC, credit scoring, collateral review, e-signature, and exception processing.

We take advantage of R&T's white label benefit and flexibility to customize our products to align with our brand.

EVP & Chief Banking Officer

New Jersey Bank

Get In Touch.

We’re Here to Help You Reach Your Business Goals.