Businesses and individuals continuously seek ways to optimize the utility of cash reserves. Cash sweep programs offer both financial institutions and their customers a strategic solution by automatically transferring excess cash into interest-bearing or insured accounts, enhancing liquidity and security.

At R&T Deposit Solutions, we specialize in helping institutions maximize their cash assets. This article explores cash sweep programs, their mechanics, and the benefits they provide to financial institutions and their customers.

What is a Cash Sweep Program?

A cash sweep program automatically transfers (or “sweeps”) excess funds from a checking or other bank account into interest-earning deposit accounts at the end of each business day. These programs not only generate returns but also offer the advantage of being able to access expanded FDIC deposit insurance coverage.

By offering cash sweep programs, financial institutions strengthen customer relationships, retain valuable deposits, and maintain the flexibility to adjust balances as funding needs evolve.

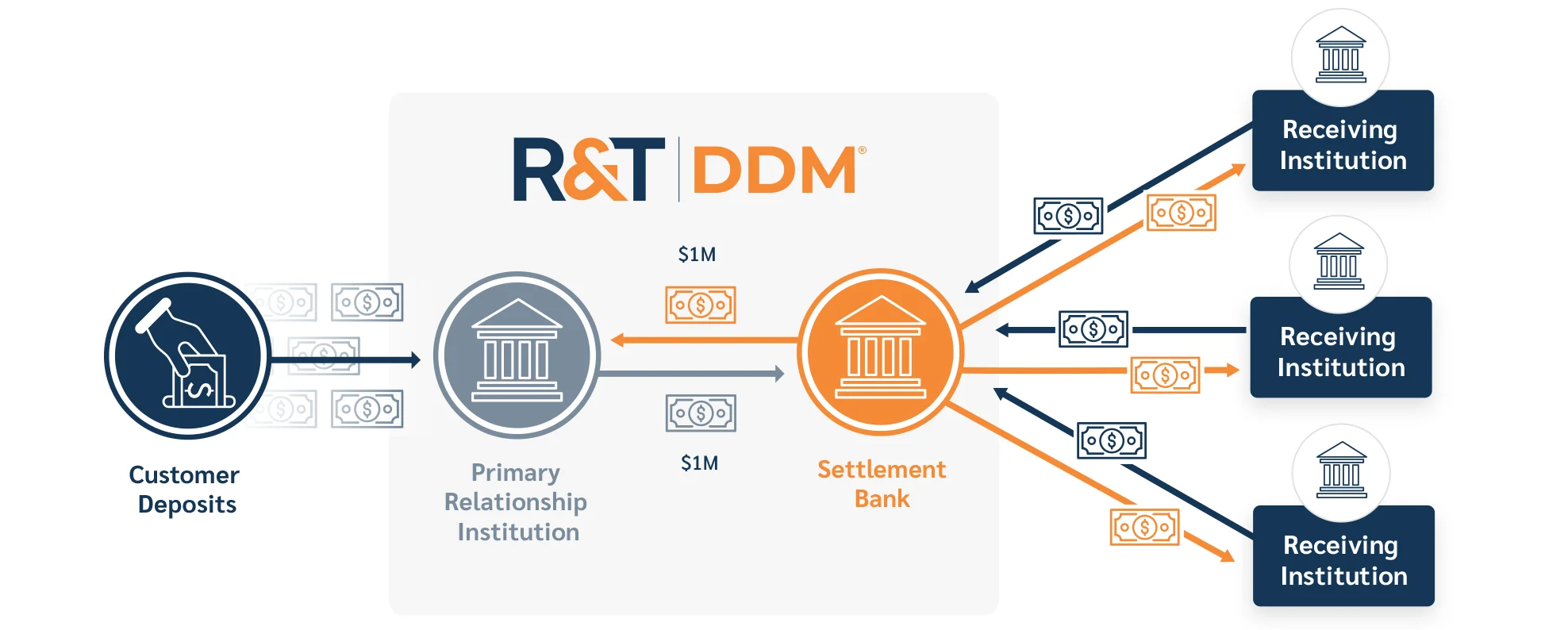

How Do Cash Sweep Programs Work?

At the close of each business day, financial institutions assess customer account balances. Any excess funds above a predetermined threshold are automatically swept into interest-bearing accounts, such as savings or money market accounts, at participating network institutions.

Cash Sweep Programs in Action

Consider a mid-sized corporation with substantial cash reserves for payroll and operational expenses. Instead of leaving excess funds idle, the company enrolls in a cash sweep program. Each evening, surplus balances are transferred into interest-bearing accounts across multiple FDIC-insured institutions participating in the network. This strategy ensures access to expanded FDIC insurance coverage, up to the program limit, while keeping funds readily accessible.

For financial institutions, cash sweep programs help maintain a stable deposit base, enhance liquidity management, and retain high-value customers who require efficient cash management solutions. These programs also support balance sheet stability by keeping deposits within the institution’s ecosystem, reducing reliance on potentially volatile funding sources.

Cash Sweep Programs: How it Works

Optimizing Cash Reserves with Cash Sweep Programs

Cash sweep programs ensure surplus balances are actively earning interest rather than sitting idle. By offering these services, financial institutions provide their customers with convenient cash management solutions while optimizing their own balance sheets. Additionally, deposit networks enhance flexibility, enabling financial institutions to:

- Retain high-balance customers seeking access to expanded FDIC insurance coverage.

- Optimize the use of collateral.

- Manage insured versus uninsured deposit levels.

- Access diversified funding sources.

Key Benefits of Cash Sweep Programs

-

Interest Earning: Cash sweep programs ensure that idle funds generate returns by moving them into interest-bearing accounts.

-

Access to Expanded Deposit Insurance Coverage: By distributing funds across multiple FDIC-insured institutions, customers may access expanded deposit insurance coverage beyond $250,000 per customer identifier (e.g., TIN) for greater financial protection.

-

Liquidity Optimization: These programs balance liquidity needs by ensuring funds remain accessible while still earning interest.

-

Efficient Cash Management: Automated sweeps minimize the need for manual transfers, allowing financial institutions to focus on business operations rather than liquidity management.

-

Balance Sheet Stability: For financial institutions, cash sweep programs support deposit retention, enhance risk management, and help promote long-term financial stability.

-

Competitive Advantage: Smaller and mid-sized institutions can leverage cash sweep programs to compete with larger banks and other financial institutions, attracting and retaining high-value customers with advanced cash management solutions.

How Financial Institutions Can Leverage Cash Sweeps

Cash sweep programs empower financial institutions to optimize cash flow, enhance earnings, and maintain liquidity—all while simplifying financial management for their customers.

At R&T Deposit Solutions, we are committed to helping institutions achieve financial efficiency and growth. Our cash sweep programs are designed to optimize fund allocation, provide interest earnings, and provide access to expanded FDIC deposit insurance coverage. Whether your institution seeks to streamline cash management or enhance deposit protection, our team is here to guide you in configuring a solution tailored to your needs.

Contact us today to learn more about implementing a cash sweep program that works for you.