The most significant benefit of reciprocal deposit networks is the ability to offer customers access to expanded FDIC insurance on large deposits. Ensuring the protection of funds through deposit insurance without engaging multiple institutions is appealing to individuals and businesses alike. This protection especially benefits municipalities, nonprofits, businesses, and high-net-worth individuals looking to keep substantial cash reserves safe.

In the ever-evolving landscape of banking and financial services, institutions continually seek innovative solutions to attract and retain deposits while managing their liquidity efficiently. One such innovative tool that institutions are increasingly turning to is reciprocal deposits. Reciprocal deposits enable depository institutions, including community banks, to offer access to an expanded level of FDIC insurance on large deposits, often at levels well beyond the standard deposit insurance limit of $250,000.

In this article, we discuss what reciprocal deposits are, how they work to provide access to expanded FDIC insurance coverage, and how both depository institutions and their customers can benefit.

What Are Reciprocal Deposits?

Reciprocal deposits are a deposit arrangement where a depository institution that participates in a deposit network places its customers’ funds into the network to access expanded deposit insurance on those funds and receives, in return, deposits from other participating institutions in equal amounts. This strategy enables each participating institution to insure large customer balances by allocating deposits across multiple other participating institutions in the network. Depository institutions allocate funds in amounts below the FDIC’s deposit insurance limit of $250,000 at each participating institution while retaining access to valuable deposits from the network. The experience is seamless for customers, who can benefit from expanded deposit insurance on their funds and maintain their primary relationship with a single institution.

The FDIC defines reciprocal deposits as “deposits received by an agent institution through a deposit placement network with the same maturity (if any) and in the same aggregate amount as covered deposits placed by the agent institution in other network member banks.”

In 2018, the FDIC issued a final rule clarifying that, under certain conditions, reciprocal deposits should not be considered brokered deposits. Specifically, well-capitalized and well-rated institutions can exclude reciprocal deposits from being treated as brokered deposits up to the lesser of 20% of their total liabilities or $5 billion.

This regulatory treatment underscores the FDIC’s recognition of reciprocal deposits as a stable source of funding for banks, distinguishing them from traditional brokered deposits.

How Do Reciprocal Deposit Networks Work?

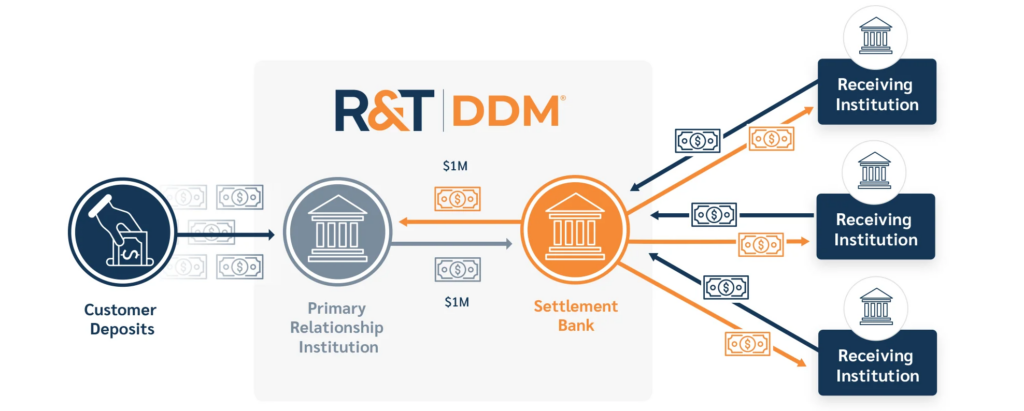

A customer deposits a large sum into a depository institution. To access expanded FDIC coverage, the institution places those deposits into accounts at other receiving depository institutions within the reciprocal deposit network in increments of up to $250,000 per customer identifier (e.g., TIN) per receiving institution. In exchange, those receiving institutions send funds back to the customer’s depository institution in an equivalent amount, maintaining a balanced exchange. This exchange enables the entire deposit amount to be eligible for FDIC insurance up to the relevant program limit, typically many millions of dollars, without the primary institution losing deposits.

Reciprocal Deposits in Action

For example, a local municipality receives a $5 million tax revenue deposit and wants to ensure the entire amount is FDIC-insured. Instead of opening multiple accounts at different banks, the municipality deposits the full amount at its primary bank. The primary bank then sends those funds into the reciprocal deposit network to be placed into accounts at multiple other receiving institutions. The amount deposited at each receiving institution stays within the FDIC’s $250,000 insurance limit. However, the municipality maintains a single banking relationship with its primary bank and can access its funds at any time.

Why Reciprocal Deposits Are a Stable Funding Source

Traditional brokered deposits can be volatile and move quickly between banks seeking the highest rates. Reciprocal deposits can provide more stability since they originate from local businesses, municipalities, and high-net-worth individuals looking for security and convenience and tend to remain within the banking system longer. The FDIC acknowledges this stability by providing favorable regulatory treatment for well-capitalized banks holding reciprocal deposits.

Benefits of Reciprocal Deposits

Access to Expanded FDIC Deposit Insurance

Customer Retention

By providing an option to insure large deposits, depository institutions can retain customers who might otherwise move their funds to larger banks that they perceive as safer or that have more extensive deposit insurance coverage options. By ensuring that large deposits remain insured through a reciprocal deposit network, banks can retain deposits, strengthen client relationships and provide added value to customers looking for safety and convenience.

Liquidity Management

Reciprocal deposits help institutions manage their liquidity by enabling them to hold onto large deposits that customers might otherwise place at institutions outside their local communities. As a result, institutions can continue lending and funding community projects without needing to rely as heavily on more expensive wholesale funding or external capital sources.

Community Investment

Institutions can better support community lending and investment by using reciprocal deposits to keep deposits within the local banking system. Instead of losing large deposits to more sizable institutions outside their region, community banks can use these funds to offer loans to local businesses, finance homeownership, and support economic development.

Simplified Account Management

For depositors, reciprocal deposits simplify the management of large deposit amounts by consolidating their funds into a single relationship, eliminating the need to juggle accounts at multiple depository institutions.

Balance Sheet Management

Reciprocal deposit networks help participating institutions more efficiently manage their balance sheet and liquidity positions by retaining access to funding from other institutions within the network. By retaining large deposits, institutions can maintain a more stable deposit base and reduce reliance on short-term or wholesale funding to meet their liquidity needs.

Competitive Advantage

Participating in a reciprocal deposit network can provide a competitive edge to smaller depository institutions, enabling them to compete more effectively with larger institutions, which often are able to offer more comprehensive deposit insurance options to their customers.

Cost Efficiency

With reciprocal deposits, participating institutions can exchange deposits with other institutions in the reciprocal deposit network on a dollar-for-dollar basis, enabling them to manage costs with non-brokered treatment (up to $5 billion or 20% of liabilities). This reciprocity gives participating institutions greater flexibility to use reciprocal deposits instead of other more expensive funding sources.

Conclusion

Reciprocal deposits represent a sophisticated financial tool that benefits depository institutions and their customers. For depository institutions, particularly smaller community banks, reciprocal deposits are a strategic way to manage their balance sheets, providing liquidity and stability while offering their customers access to expanded deposit insurance coverage. Customers at participating institutions benefit from the simplicity and the peace of mind that comes with access to expanded deposit insurance – without the hassle of managing accounts at multiple depository institutions.

At R&T Deposit Solutions, we recognize the importance of innovating responsibly to support our clients and their customers. Through the Demand Deposit Marketplace® (DDM®) Program and other deposit and funding programs, we help our clients optimize their balance sheets and capital management. Contact us today to learn how to attract, grow, and retain more deposits.