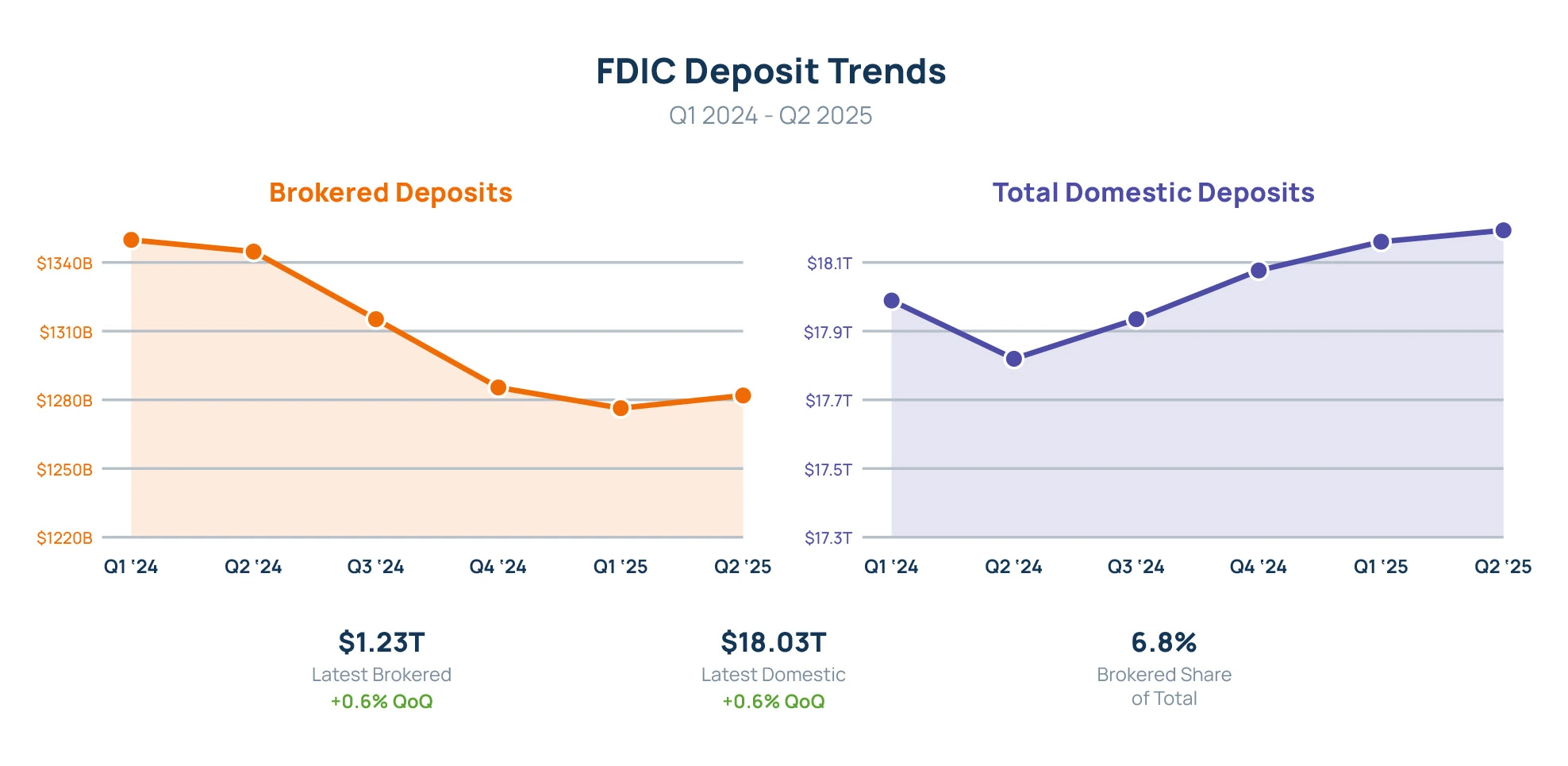

The FDIC’s Quarterly Banking Profile for Q2 2025 dropped on August 26th and shows a continued trend in deposit behavior. Insured balances rose for the fourth consecutive quarter, up $110.5 billion in Q2, while reliance on brokered deposits remained muted after five straight quarters of decline through Q1 2025. The data indicates a move toward FDIC-insured funding sources and away from rate-sensitive channels.

Declining Rates Will Drive Demand for Safer Alternatives

Historical data shows a clear correlation between interest rate changes and deposit behavior. As the Fed pushed rates from 4% to 5.4% in 2023, brokered balances climbed while domestic deposits slipped. While there is no certainty, lowered federal rates could accelerate the increased reliance on alternatives. The data below illustrates how these deposits have historically responded to changes in interest rates.

Alternatives to Money Market Funds

Many trust organizations rely on Federal Home Loan Banks (FHLB) for fiduciary cash. They’re familiar, easy to administer, and deeply embedded in existing platforms. However, recent FDIC data indicates that client priorities are shifting toward insured and liquid balances rather than chasing rates. And, as we’ve seen historically, money market funds become less desirable as rates fall.

For some institutions, the focus on providing access to expanded FDIC-insured alternatives is becoming more attractive. Cash sweep programs offer same-day liquidity and rates competitive with those of money market funds, making them easy to position for clients seeking safer alternatives. This makes them particularly attractive to trust organizations seeking to protect customer deposits while earning competitive yields.

As we’ve seen from past performance, each rate cycle reinforces the same outcome: when yield matters most, brokered deposits and money funds attract attention; when the cycle turns, insured balances regain priority. Increased regulatory pressure also enters the narrative, and insured cash positions are often seen as an additional source of stable funding.

R&T Deposit Solutions for Trust Organizations

The Demand Deposit Marketplace® (DDM®) program, administered by R&T, allows trusts to strategically manage their balance sheet liquidity and deposit funding needs while offering customers access to expanded deposit insurance coverage.

For all trust organizations, R&T solutions provide:

-

Access to expanded FDIC insurance coverage on large balances.

-

Same-day liquidity comparable to money funds.1

-

Competitive rates aligned with market cycles.2

-

Seamless integration into existing trust accounting platforms.

R&T solutions integrate with more than 50+ core processors and adapt to client formats without requiring changes to existing systems, giving trusts the flexibility to adopt insured cash programs without disruption. Through R&T’s portals, APIs, and data-exchange tools are also in place, providing real-time visibility into balances, transactions, and reporting, so trust officers have the information they need without manual workarounds.

FDIC-Insured cash sweep solutions offer a means to address pressures related to protecting client relationships, meeting fiduciary obligations, and generating consistent, predictable funding. Institutions that adopt these alternatives will be better positioned to weather rate shifts and regulatory scrutiny in the years ahead.

1 Under the DDM program, funds are deposited into demand deposit accounts (DDAs) or money market deposit accounts (MMDAs) at receiving banks or share draft accounts or share accounts at receiving credit unions. While your customers’ funds are held in MMDAs or share accounts, the return of your customers’ funds from the DDM program may be delayed as, under federal regulations, the receiving institution is permitted to impose a delay of up to seven days on any withdrawal request from an MMDA or share account.

2 While interest rates obtained on funds placed at receiving institutions under the DDM and/or RTID programs may, under certain circumstances, outperform cash alternatives, such as money market funds, the primary objective of the DDM and/or RTID programs is to provide customers with convenient access to expanded FDIC insurance coverage on their funds (and not for investment enhancements or higher rates of returns or profits).