By: Jeff Zuendt, EVP & Chief Deposit Officer at R&T Deposit Solutions

After nearly two years of providing banks with an additional financing option, the Bank Term Funding Program (BTFP) officially came to an end on March 11, 2025 – marking a new phase in bank funding dynamics. Introduced by the Federal Reserve in March 2023 in response to the regional banking crisis, the BTFP offered one-year loans to depository institutions using high-quality collateral. While it served as a critical backstop for liquidity in the most uncertain days of the crisis, the program was always intended as a temporary measure.

Other factors have added pressure to a challenging banking landscape. With the Federal Reserve pausing further rate cuts amid increased volatility, banks are reevaluating their funding strategies and taking steps to adjust to a shifting liquidity environment.

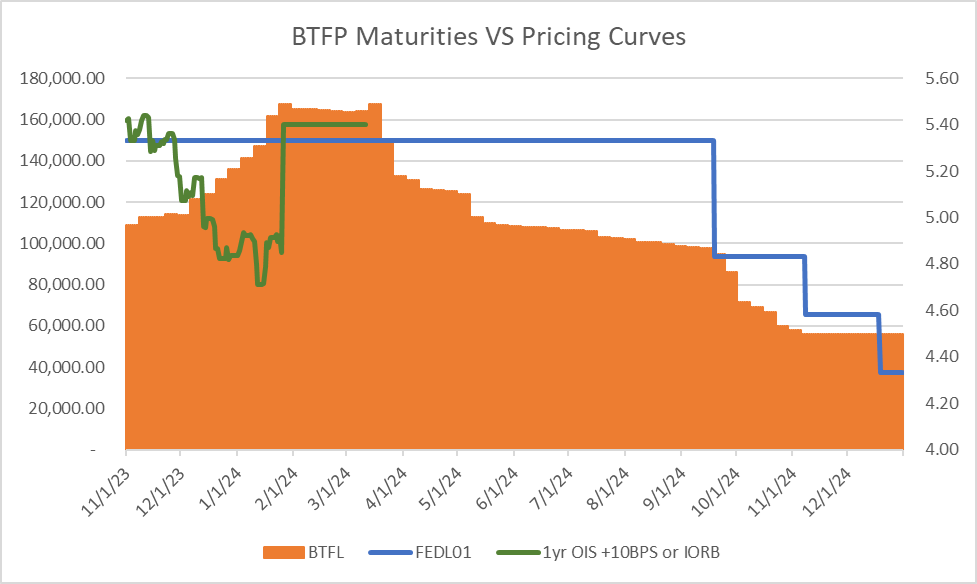

Since the Fed has already reduced rates by 100 basis points, the Interest on Reserve Balances (IORB) – the rate the Fed pays banks to hold reserves – now stands at 4.40%. This rate was creating a negative spread for many institutions that had previously relied on BTFP funding. Data from November through December 2024 (seen in the graph below) suggests that banks preemptively paid down these borrowings in preparation for the program’s expiration.

With BTFP no longer an option, banks may need to tap alternative funding sources such as the discount window, the Federal Home Loan Bank, or the repo market – all of which require collateral. In this landscape, stable non-collateralized funding solutions tied to effective federal funds, such as programs administered by R&T, provide an opportunity to optimize balance sheets while maintaining flexibility.

As funding conditions evolve, robust capital solutions and data-driven insights will be essential for banks aiming to reinforce liquidity and sustain competitiveness in a post-BTFP environment. Contact us to learn how our innovative approach can help your organization navigate these changes with confidence.

Click here for R&T’s list of receiving institutions in the DDM, CDMX and RTID programs. R&T is not an FDIC or NCUA-insured institution. FDIC and NCUA insurance only covers the failure of an FDIC or NCUA-insured institution. Certain conditions must be satisfied for pass-through deposit insurance to apply.