The Federal Reserve’s first rate cut of 2025 marked the beginning of a new phase in cash management. Customers spent 18 months chasing 5% yields in money market funds only to find that advantage now fading. For fiduciary leaders, it’s a balancing act of providing customer yield while fulfilling fiduciary duty. Customers may inquire about why their “safe cash” yields are declining, while examiners continue to scrutinize how trust companies and financial institutions manage uninsured exposures.

Customers Expect More Than Yield

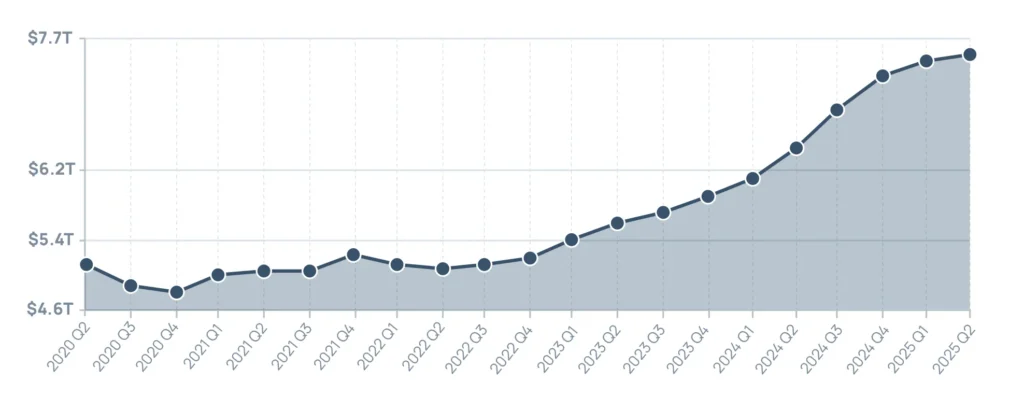

Money market funds soared to a record $7.4 trillion in September, according to the Investment Company Institute (ICI) data.

The draw was simple: while FDIC national data showed savings deposit rates averaging just 0.47% in 2023 (FDIC National Rates), prime MMFs were paying north of 5% (Morgan Stanley analysis).

However, their appeal is fading fast. UBS’ CIO has called it “an imperative to put cash to work,” (Family Wealth Report) while Morgan Stanley warns that “higher money market fund returns won’t last.” (Morgan Stanley Wealth Management).

The reality: without an insured, liquid option to present, fiduciary institutions risk eroding customer trust or losing balances altogether.

For most fiduciary customers, priorities are clear:

-

Principal protection

-

Daily liquidity1

-

Transparency and control

Insured sweep solutions consistently meet these expectations across cycles, while avoiding the reinvestment risk commonly associated with MMFs.

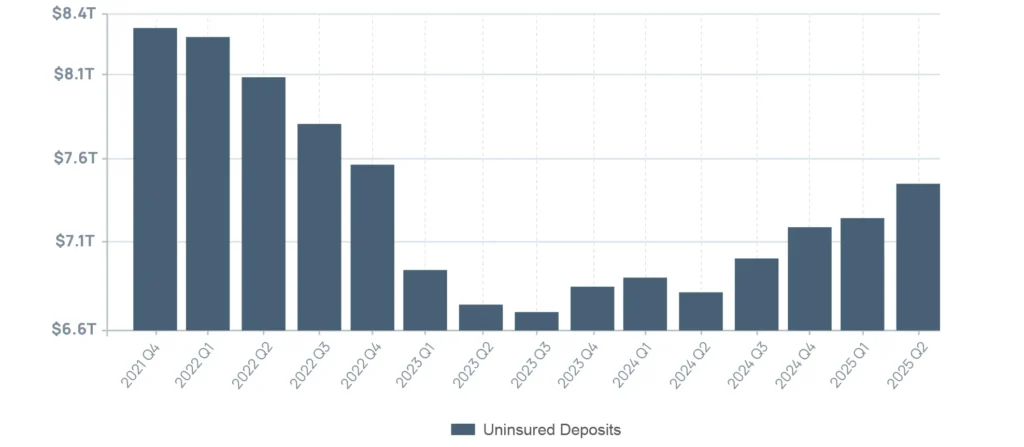

Examiner Pressure on Uninsured Balances

The FDIC’s Q2 2025 Quarterly Banking Profile reported a $218.5 billion (3.0%) increase in uninsured deposits. Examiners expect not just awareness but clear action. Through reciprocal deposit programs, fiduciaries can provide their customers with access to expanded deposit insurance coverage through a network of banks. This structure diversifies exposure and demonstrates a proactive approach that will be appreciated by both regulators and clients.

Importantly, under S.2155 (the Economic Growth, Regulatory Relief, and Consumer Protection Act), qualifying reciprocal deposits receive favorable regulatory treatment as non-brokered up to the lesser of $5 billion or 20% of liabilities (FDIC guidance). For examiners, that makes them both compliant and confidence-building.

Money Market Fund Uncertainty

History shows why fiduciaries can’t rely on MMFs as a core strategy:

-

2008: Reserve Primary Fund “broke the buck” after Lehman’s collapse (Yale Journal of Financial Crises).

-

2020: Pandemic stress forced the Fed to intervene with the Money Market Liquidity Facility (MMLF) (FSB/ICI Report).

-

2022–24: Yields surged, but are now reversing as rates fall (Morgan Stanley).

Each cycle proves the same point: money funds are cyclical, not structural. Fiduciaries require a solution that maintains safety and liquidity throughout the entire cycle, not just during yield spikes.

Redefining the Fiduciary Standard

The measure of fiduciary leadership may well be changing away from who captured yesterday’s 5% return, to who best safeguarded client confidence.

This future standard of fiduciary cash management may rest on four pillars:

-

Insurance: Access to expanded FDIC deposit insurance coverage that removes NAV and credit risk

-

Liquidity1: Same-day liquidity comparable to money market funds

-

Yield2: Competitive rates aligned with market cycles

-

Structure: Recognized deposits, not securities, that are fully aligned with examiners’ expectations

Insured sweep and reciprocal deposit programs align with these pillars, transforming fiduciary cash management into a clear example of sound judgment, regulatory care, and responsible oversight.

Built for fiduciaries, the Demand Deposit Marketplace® (DDM®) program, administered by R&T, enables trust companies to offer their customers access to expanded FDIC-deposit insurance coverage across a nationwide bank network. Bank-affiliated trusts can count these balances toward stable wholesale funding without being labeled as brokered. For independent trust companies, the DDM program often simplifies operations while strengthening client relationships.

For all trust organizations, R&T’s solutions provide:

-

Access to expanded FDIC deposit insurance coverage.

-

Same-day liquidity comparable to money funds.1

-

Competitive rates aligned with market cycles.2

-

Seamless integration into existing trust accounting platforms.

-

Digital transparency through APIs, portals, and real-time reporting.

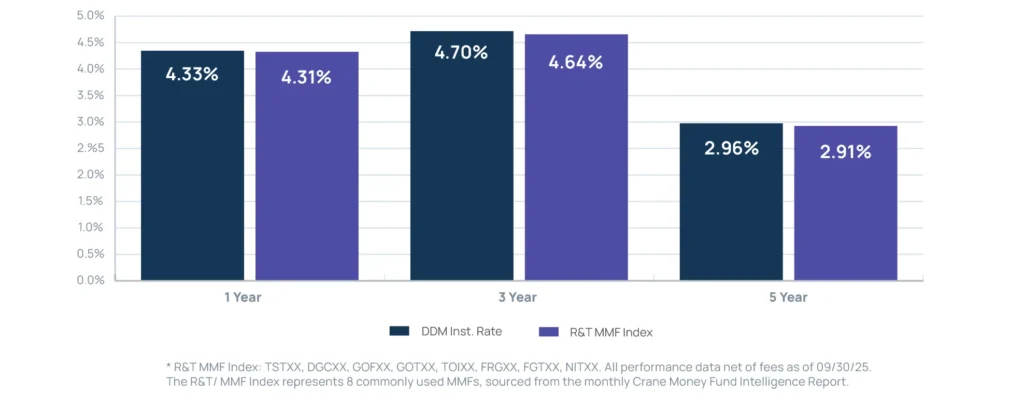

Over 1-, 3-, and 5-year periods, rates at which interest is paid under the DDM Program’s Institutional Rate have historically been higher than the yields on a basket of institutional government MMFs. The result is not just higher client satisfaction, but demonstrable fiduciary leadership.

Performance Data

R&T’s solutions integrate with more than 50+ core processors and adapt to client formats without requiring changes to existing systems, giving trust companies the flexibility to adopt insured cash programs without disruption. R&T’s portals, APIs, and data-exchange tools also provide real-time visibility into balances, transactions, and reporting, allowing trust officers to access the information they need without manual workarounds.

The Fiduciary Imperative

Rate cycles will shift. Market headlines will change. But fiduciary responsibility remains constant: protect principal, preserve liquidity, and inspire client confidence.

That’s why insured sweep solutions are no longer optional. We believe that they are emerging as the new fiduciary standard. With R&T’s proven leadership and expertise, trust executives can navigate today’s shifting environment while positioning their institutions for long-term resilience.

Learn how R&T can help you navigate insured sweep solutions with the DDM® program.

Demand Deposit Marketplace® (DDM®) Program: FAQs for Trust Companies

2 While interest rates obtained on funds placed at receiving institutions under the DDM and/or RTID programs may, under certain circumstances, outperform cash alternatives, such as money market funds, the primary objective of the DDM and/or RTID programs is to provide customers with convenient access to expanded FDIC insurance coverage on their funds (and not for investment enhancements or higher rates of returns or profits).