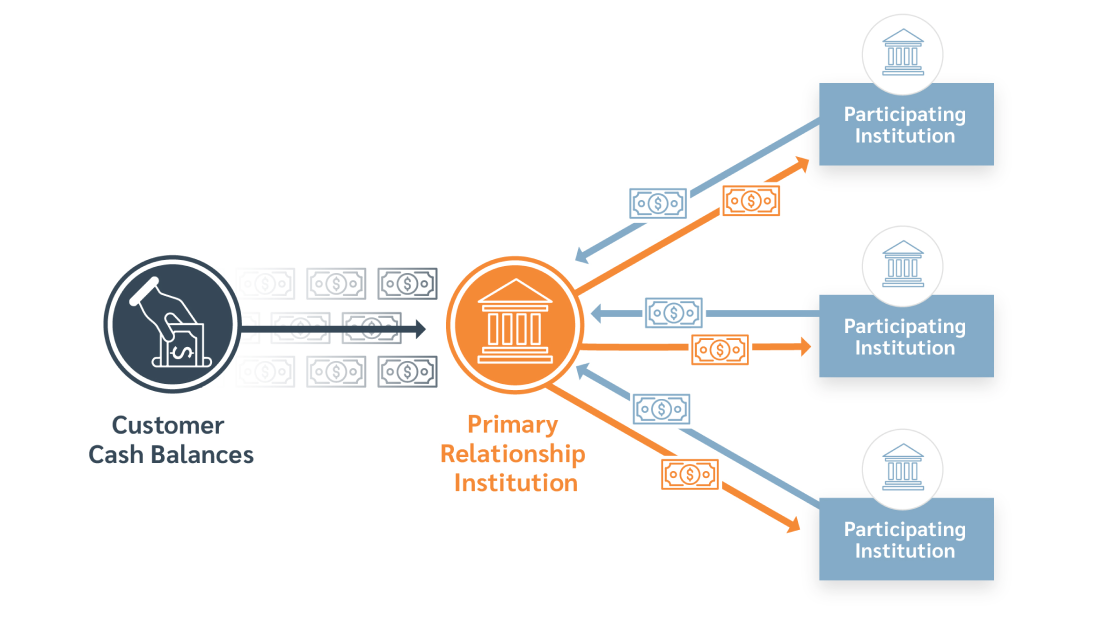

The Demand Deposit Marketplace® (DDM®) program allows banks and other depository institutions to take advantage of the reciprocal feature to satisfy the deposit insurance coverage needs of its customers, retain access to valuable deposits, and reduce the level of uninsured deposits reported on their balance sheet.

The Demand Deposit Marketplace® (DDM®) program allows banks and other depository institutions to take advantage of the reciprocal feature to satisfy the deposit insurance coverage needs of its customers, retain access to valuable deposits, and reduce the level of uninsured deposits reported on their balance sheet. -

Access to expanded deposit insurance coverage.

-

An alternative to money market funds that provides daily liquidity.1

-

Interest rates that are competitive with other cash sweep options.2