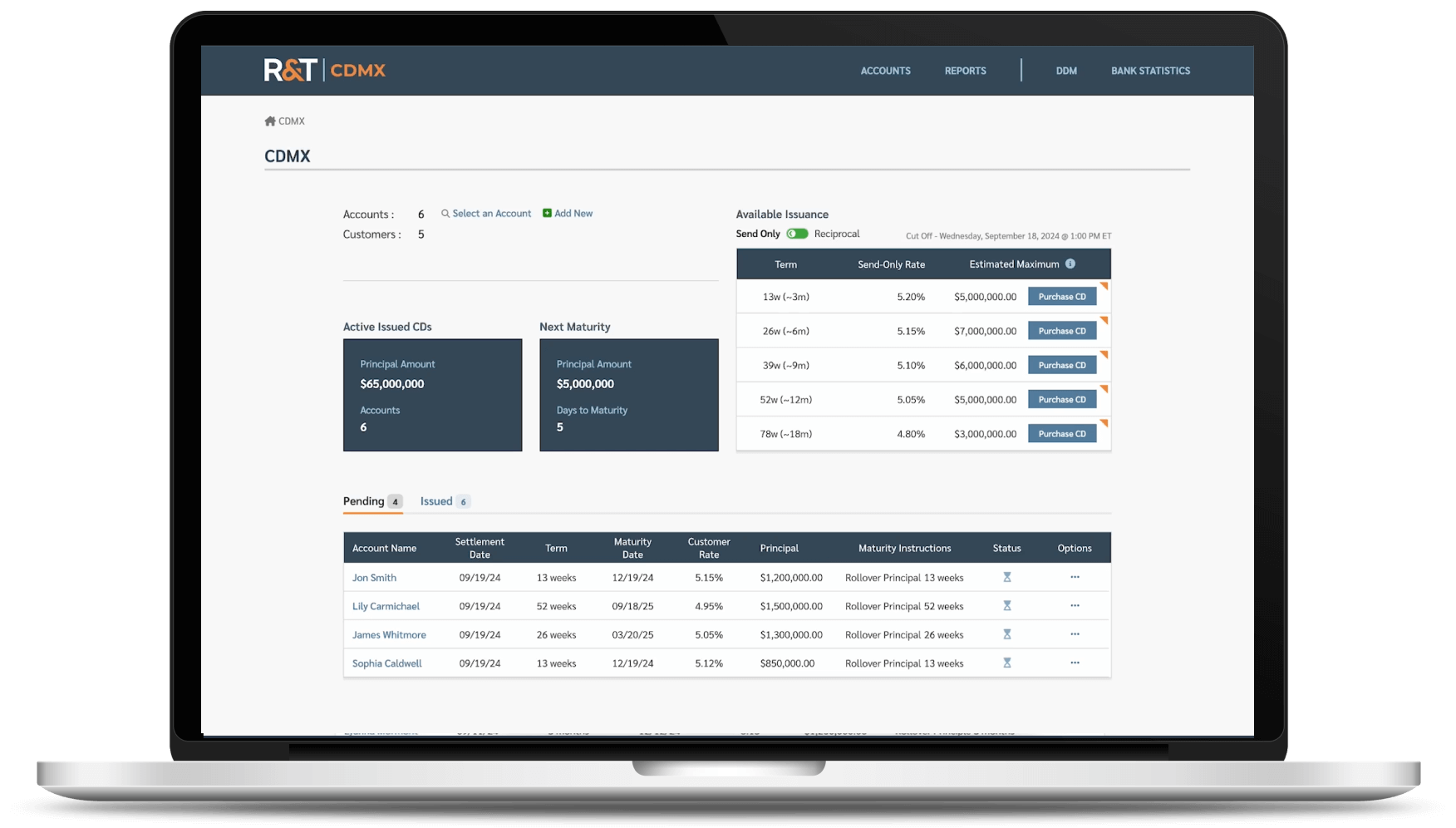

How It Works

Under the CDMX program, your customers’ funds are allocated and placed into CDs at multiple receiving institutions, in

increments of up to $250K, per customer identifier (e.g., TIN), per receiving institution. This allows your customers to access an expanded level of deposit insurance coverage on their eligible funds up to a program limit. Even though your customers’ funds are held in CDs at multiple receiving institutions, they can still access their funds through a single relationship with your firm.