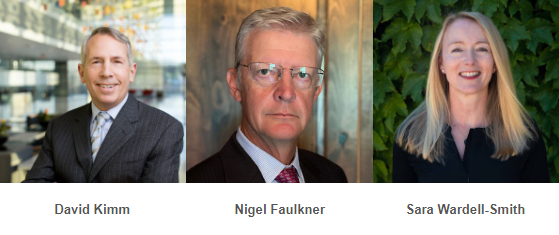

Experienced Industry Executives David Kimm, Nigel Faulkner and Sara Wardell-Smith Named Independent Managers, Underscoring R&T’s Commitment to the Highest Standard of Governance and Oversight

R&T Deposit Solutions (“R&T”), a leading provider of tech-enabled cash management and deposit placement programs, announced today the appointments of David Kimm, Nigel Faulkner and Sara Wardell-Smith as Independent Managers of its Board of Managers. These distinguished industry veterans bring a wealth of leadership skills and experience in areas including risk management and technology that will drive strategic growth, enhance service excellence and help R&T continue its trajectory of success, innovation and leadership within the industry.

David Kimm is a highly accomplished financial services executive leader with deep expertise in designing, building, integrating, and optimizing complex business operations. Currently a senior advisor at McKinsey & Co., and previously the Chief Risk Officer and Treasurer at TD Ameritrade Holding Co., David brings a comprehensive understanding of the complete business lifecycle. His prior executive roles included CFO positions at Fidelity Investments, including EVP of the Institutional Brokerage Group, and as CRO for Wells Fargo Advisors. In addition to subsequent executive roles, David served as a Board Member of the Depository Trust and Clearing Corporation (“DTCC”), as well as in Board of Directors roles at several TD Ameritrade operating subsidiaries. David will also chair R&T’s Audit, Risk & Compliance (“ARC”) Committee.

Nigel Faulkner brings over 30 years of Global Financial Services Technology experience; formulating and executing business critical strategy, driving innovation and delivering competitively defining change as CIO/CTO at leading global financial organizations, including T Rowe Price, Goldman Sachs and Credit Suisse. Nigel has a strong track record of leading innovative change for the most critical global businesses and products. Nigel also sits on the boards of the DTCC, where he chairs the Technology and Cyber Committee, and Allspring Global Investments. He will also become a member of the ARC.

Sara Wardell-Smith is the former head of Visa’s commercial business across North America and was responsible for product, partnerships, sales and platforms. While at Visa, she led financial institution initiatives that modernized the company beyond cards into real-time payments, cross-border payments and new payment flows. Prior to Visa, Sara was an Executive Vice President at Wells Fargo and served on the Management Committee. She is an experienced board member and advisor with extensive experience in wholesale banking, global payments and fintech partnerships. Sara serves on the board for Axos Financial, a technology-driven financial services company, and previously served on the U.S. board of Revolut, one of the world’s largest and fastest-growing fintech companies and challenger banks, and the CLS Group, which operates the world’s largest multi-currency cash settlement system designed for financial institutions. She will also become a member of the ARC.

“I am thrilled to welcome three seasoned industry experts to our Board of Managers,” stated Susan Cosgrove, Executive Chairperson of R&T Deposit Solutions. “Their deep experience and strategic insights will enhance our ability to navigate complex challenges and uphold the highest standards of risk management, governance and compliance. The addition of these experienced leaders also continues to build on R&T’s recent momentum including the expansion of our management team and platform through the addition of new executive leaders and business partners to drive further execution and enhance client offerings.”

The addition of these members to the Board marks another important milestone for R&T. In September 2023, Susan Cosgrove joined R&T as Executive Chairperson, partnering with CEO Joe Jerkovich to further establish the leadership team and to drive the company’s strategy behind a substantial new growth investment. Since that time, the company has built out its senior team with several key hires, including the appointment of Christopher Gerosa as Chief Financial Officer, Jason Mull as Chief Risk Officer & Chief Information Security Officer, Jason Cave as Strategic Advisor for Regulatory and External Relations and Mieko Shibata as Chief Information Officer. R&T also recently announced a collaboration agreement with Supernova Technology, a leading financial technology company, which will leverage complementary services in securities-based loan management systems and FDIC-insurance cash sweep and deposit placement programs to benefit all clients through an enhanced service offering. Read more About R&T Deposit Solutions Announces Strategic Collaboration Agreement here.

R&T is a portfolio company of private equity firms GTCR and Estancia Capital Partners (“Estancia”). Estancia originally invested in R&T in 2021 and GTCR invested in 2023 and have partnered with the company to help sustain the growth in its depository network offering while investing to broaden its product offerings and technology infrastructure.

About R&T Deposit Solutions

Celebrating 50 years in the industry, R&T Deposit Solutions provides cash management and deposit placement programs to the financial services industry. Through its tech-enabled services, R&T helps banks, credit unions, broker-dealers, trust companies and wealth managers meet their unique cash sweep and deposit funding needs. As a recognized leader in the administration of deposit networks, the Demand Deposit Marketplace® (DDM®) program administered by R&T, provides banks and other depository institutions access to billions of dollars in reciprocal deposits and the ability to support their customers deposit insurance needs. R&T is a portfolio company with the majority interests owned by private equity firms, GTCR and Estancia Capital Partners. For more information about R&T, please visit our website at https://rnt.com. Click here for R&T’s list of receiving institutions. R&T is not an FDIC-insured institution. FDIC insurance only covers the failure of an FDIC-insured institution. Certain conditions must be satisfied for FDIC pass-through deposit insurance coverage to apply.