Flexible Cash Sweep Program to Meet Customers’ Needs

Featured in: American Banker Magazine | Nasdaq TradeTalks

Member: BaaS Association

Premier Sponsor: Bankers Helping Bankers

How It Works

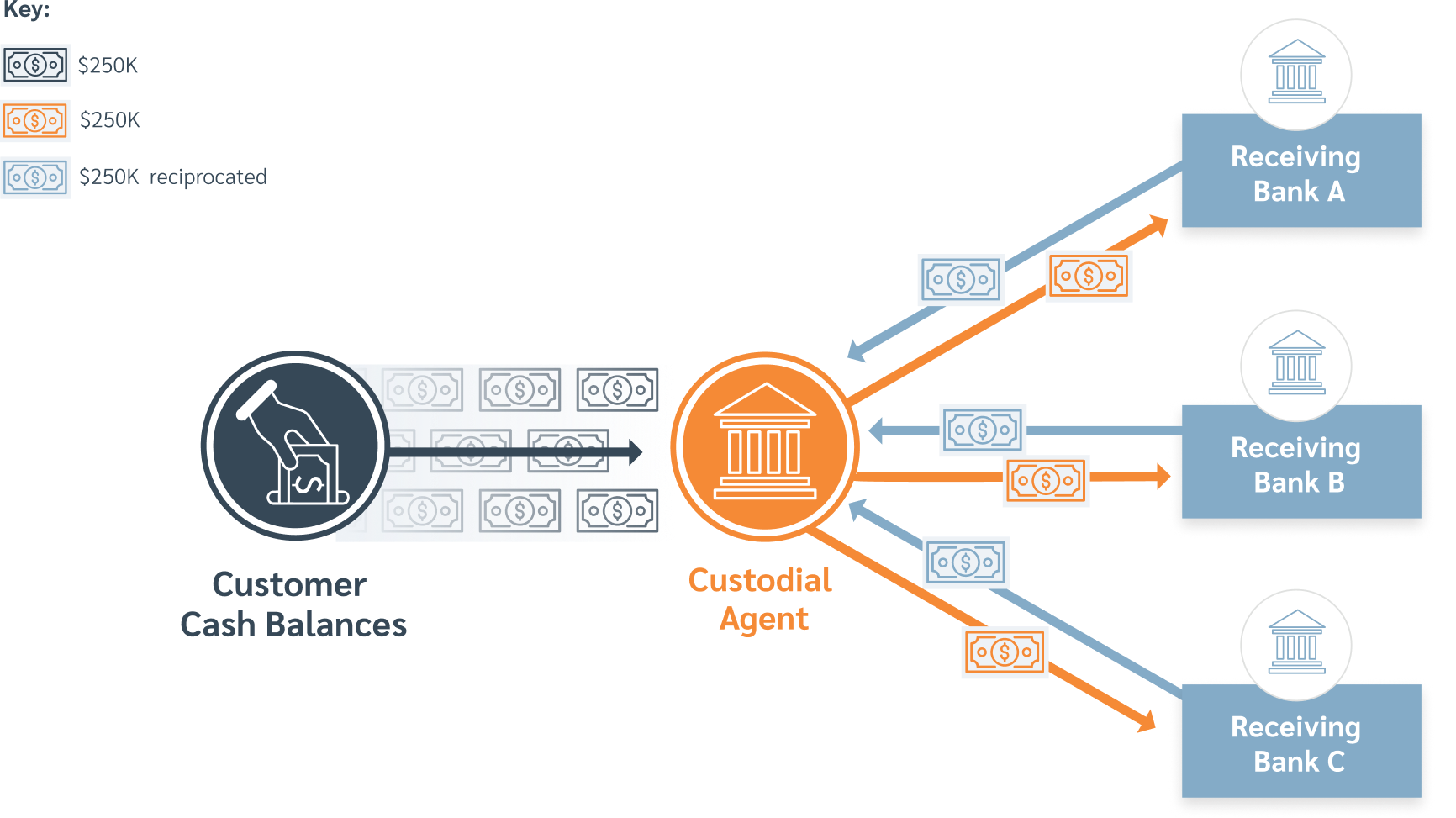

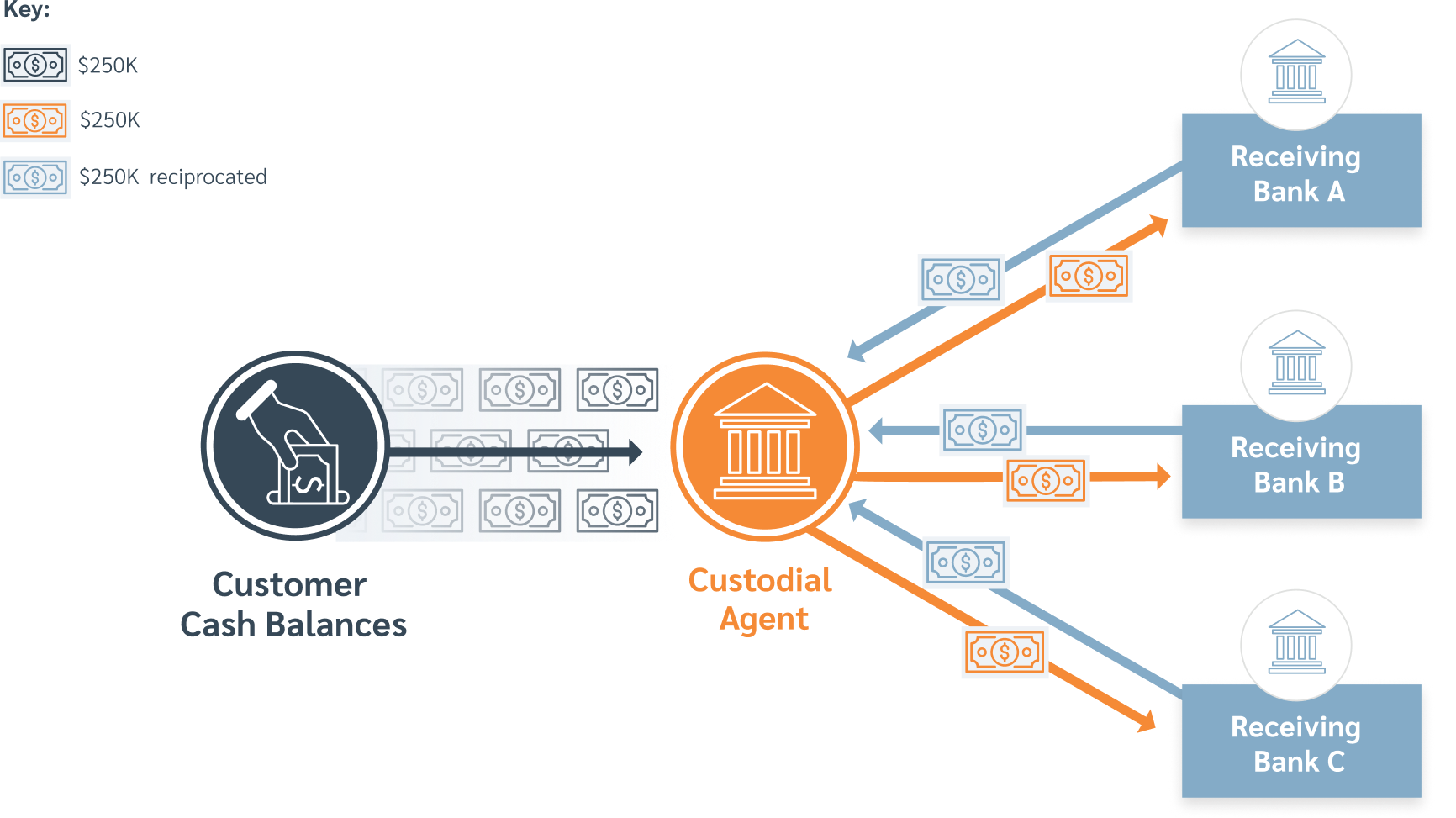

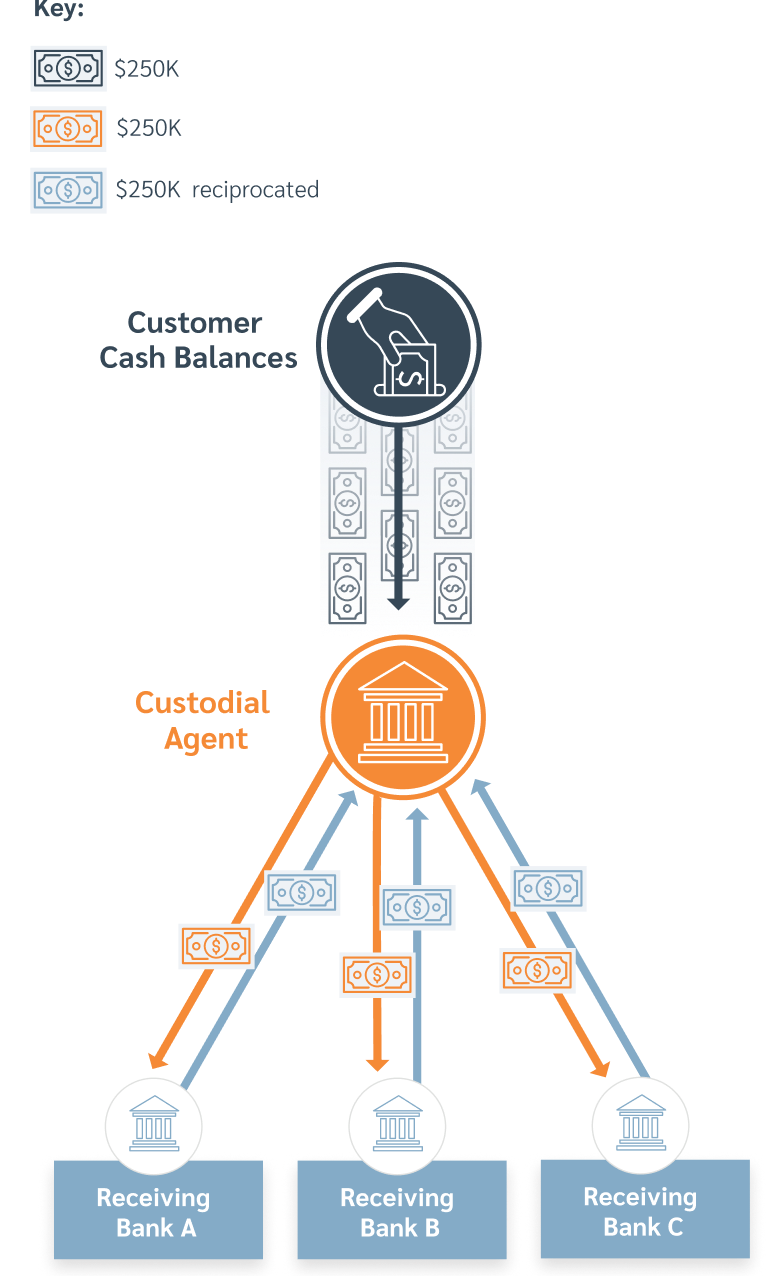

R&T uses an algorithm to match customer balance activity and program insurance limits against the available capacity offered by our network of participating banks. The broker-dealer then directs customer funds into deposit accounts so that their customer balances are FDIC-insured up to the program limit.

Cash Sweep Program Benefits

Many of the largest broker-dealers in the U.S. choose insured cash sweep programs over money market mutual funds.

With R&T's proprietary technology and large network of banks, broker-dealers have the flexibility to configure a cash sweep program that precisely meets their needs.

-

Access to an expanded FDIC insurance coverage

-

Daily liquidity

-

Diversified Network

-

Easy to implement

-

Flexible and simple to manage

-

Available for many account types

-

Rates competitive with money market funds

Trusted by financial institutions since 1974.

Cash Sweep Program Advantages

R&T’s Insured Deposits (RTID®) is a flexible cash sweep program that enables broker-dealers to set program insurance limit, define the number of rate tiers, and determine eligible client account types. Our system can accommodate multiple allocation methodologies and preferred methods of data exchange.

Customers benefit from access to expanded FDIC insurance coverage on their funds, daily liquidity, and competitive rates*.

*We provide recordkeeping and/or administrative services with respect to cash sweep and placement programs that we administer (e.g., the DDM® and RTID programs). While customer rates obtained on funds placed into those programs may, under certain circumstances, outperform cash alternatives, such as money market funds, the primary objective of our services is to provide customers with convenient access to expanded FDIC and/or NCUSIF insurance coverage on their funds (and not for investment enhancements, or higher rates of returns or profits).

The sweep deposit program provides a stable source of funding with flexibility around target balances to address our evolving funding needs over the years.

Senior Vice President, Wholesale Funding & Liquidity

National Bank

Talk to an Expert.

Let us show you how cash sweep accounts can work for you.