Liquidity Management Solutions Made Simple

Member: BaaS Association

Sponsor: National Registry of CPE Sponsors

Premier Sponsor: Bankers Helping Bankers

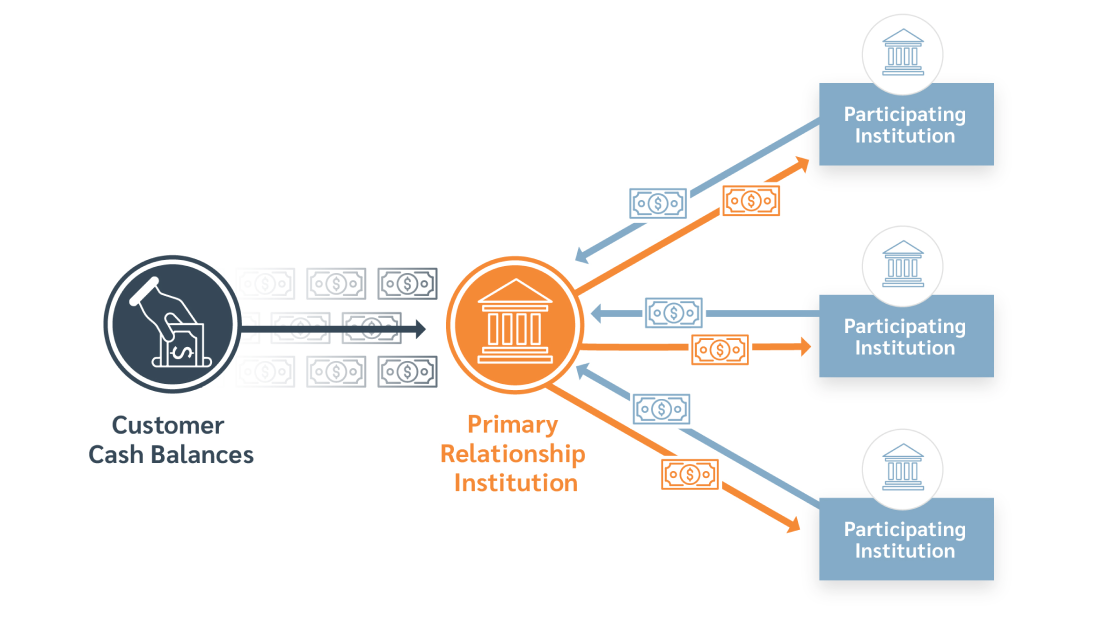

How It Works

The Demand Deposit Marketplace® (DDM®) provides your institution with a seamless way to offer its customers access to millions of dollars in expanded deposit insurance coverage from the FDIC or NCUA on their funds while strategically managing its balance sheet – by allocating deposits across our extensive network of receiving institutions.

- Offer customers access to millions in expanded deposit insurance coverage

- Access alternative sources of funding

- Manage your balance sheet liquidity levels

- Easy set up, integrates with bank platforms

- Private labeling available

Program Options

With up to four types of deposit relationships available, the DDM program offers the flexibility to increase or decrease the amount of deposits on your balance sheet at any time.

Send-Only

Send excess deposit balances

-

Access to millions in deposit insurance coverage

-

Generate fee income

-

Warehouse future on-balance sheet deposits

-

Reduce balance sheet

Receive-Only

Receive deposit funding

-

Diversify wholesale funding sources

-

Fund loan demand

-

Strengthen balance sheet

-

Supplement contingency funding plan

Reciprocal

Exchange deposits (dollar for dollar)

-

Access to expanded deposit insurance coverage

-

Receive equal insured deposits in return

-

Manage costs

-

Non-brokered treatment (up to $5 billion or 20% of liabilities)*

*Subject to applicable laws and regulations relating to non-brokered deposits, including 12 CFR 337.6. R&T makes no representations or warranties, express or implied, with respect to a bank’s classification of deposits as brokered or not brokered. Such determinations are entirely and solely the responsibility of that bank.

Reciprocal Plus/Minus

Exchange deposits (any desired ratio)

-

Access to expanded deposit insurance coverage

-

Increase/decrease target deposit levels dynamically

-

Participating institution determines reciprocal target

-

Send or receive balances above or below the reciprocal target

*Subject to applicable laws and regulations relating to non-brokered deposits, including 12 CFR 337.6. R&T makes no representations or warranties, express or implied, with respect to a bank’s classification of deposits as brokered or not brokered. Such determinations are entirely and solely the responsibility of that bank.

Trusted by financial institutions since 1974.

Program Advantages

Cash balances in your customers’ accounts are sent daily into the DDM program. The DDM program then allocates those balances to deposit accounts at FDIC or NCUA member institutions in increments below $250K per customer identifier (e.g., based on TIN) so that your customers’ balances can receive access to deposit insurance coverage up to the relevant program limit.

Participating institutions with affiliated trust departments can benefit by adding another source of stable funding.

The sweep deposit program provides a stable source of funding with flexibility around target balances to address our evolving funding needs over the years.

Senior Vice President, Wholesale Funding & Liquidity

National Bank

Talk to an Expert.

Let us help you manage your liquidity position.